This study explored the dynamic nature of neighborhoods using a relatively novel approach and data source. By using a nonparametric holistic approach of neighborhood change based on latent class analysis (LCA), we have explored how changes in the socio-demographic characteristics of residents, as well as home improvement and refinance activity by residents, are related to changes in neighborhood crime over a decade. Utilizing annual home mortgage loan data in the city of Los Angeles from the years 2000–2010, we 1) conducted principle components factor analyses using measures of residential in-migration and home investment activities; 2) estimated LCA models to identify classes of neighborhoods that shared common patterns of change over the decade; 3) described these 11 classes; 4) estimated change-score regression models to assess the relationship of these classes with changing crime rates. The analyses detected six broad types of neighborhood change: 1) stability; 2) urban investors; 3) higher-income home buyers; 4) in-mover oscillating; 5) oscillating refinance; 6) mixed-trait. The study describes the characteristics of each of these classes, and how they are related to changes in crime rates over the decade.

You can access the article by Nicholas Branic and Dr. John R. Hipp online first in Social Science Research entitled, “Growing Pains or Appreciable Gains? Latent Classes of Neighborhood Change, and Consequences for Crime in Southern California Neighborhoods”.

Get it here:

http://www.sciencedirect.com/science/article/pii/S0049089X16307931

Abstract:

This study explored the dynamic nature of neighborhoods using a relatively novel approach and data source. By using a nonparametric holistic approach of neighborhood change based on latent class analysis (LCA), we have explored how changes in the socio-demographic characteristics of residents, as well as home improvement and refinance activity by residents, are related to changes in neighborhood crime over a decade. Utilizing annual home mortgage loan data in the city of Los Angeles from the years 2000–2010, we 1) conducted principle components factor analyses using measures of residential in-migration and home investment activities; 2) estimated LCA models to identify classes of neighborhoods that shared common patterns of change over the decade; 3) described these 11 classes; 4) estimated change-score regression models to assess the relationship of these classes with changing crime rates. The analyses detected six broad types of neighborhood change: 1) stability; 2) urban investors; 3) higher-income home buyers; 4) in-mover oscillating; 5) oscillating refinance; 6) mixed-trait. The study describes the characteristics of each of these classes, and how they are related to changes in crime rates over the decade.

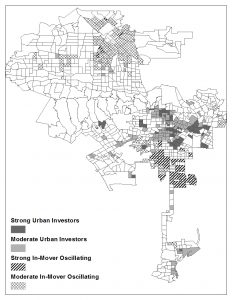

Map of Urban Investors classes (Strong and Moderate) and In-Mover Oscillating classes (Strong and Moderate) in Los Angeles City.

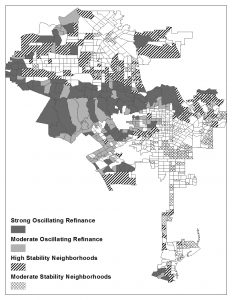

Map of Oscillating Refinance classes (Strong and Moderate) and Stability classes (High and Moderate) in Los Angeles City.

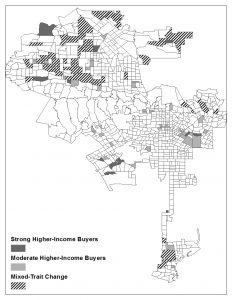

Map of Higher-Income Buyers classes (Strong and Moderate) and Mixed-Trait Change class in Los Angeles City.